FAQ Questions:

1) What is DOSIP?

DOSIP is a portal with the sole purpose of disseminating information about investing SIP. It will serve as Knowledge Park to share, learn, advice on how to go about investing especially the SIP way

2) How do I benefit?

The success of any investment is discipline and SIP is the disciplined way to investing which is the secret and nothing else. So by following through the update around the time, we intend to share knowledge and create wisdom

3) Why SIP is important?

SIP is the first step to wealth creation. If you have not started your SIP then you are not saving enough.

4) How many goals to have?

One can have as many goals as possible. As long as you can spare some monthly savings to each of the goals without disruption then you are good to go. The best part is that you start your savings commitment before your spending commitment. So you follow the golden rule of spending what is left out after saving.

5) When is the ideal time to start SIP?

Start early. The first salary should coincide with the first SIP. So you ensure your retirement goal first and then the immediate goals. The difference between starting your SIP by age 25 instead of 30 can mean that you can double your corpus on retirement. Time is money. So start early and save wisely.

6) For how long should I save?

This depends on the goal. If you have a kid of 3 years old then you may plan for education 15 years from now so you can start SIP for 15 years. If you are 30 and you want to create a retirement corpus then you plan for 30 years. So the goal will determine your length of time.

7) Markets are at a peak, should I wait?

Not really. SIP is an investment over a long period and even outs the market odds by investing regularly. So you should start right away when you can spare some money for your wealth or any financial goal. On the other hand, after you start your SIP if markets were to correct then add some more investment to benefit of lower price or NAV and in the long run, it can help to build wealth.

8) How to choose my SIP Plan?

You should start with the large-cap fund. Later you can add midcap and if required small-cap funds if your risk profile allows doing that. But asset allocation mix is a function of risk profile and not a function of market opportunity. So go with what suits you and not what the market tells you to do.

9) What are Mutual Funds and how is it different?

Mutual Fund is an aggregate of money collected from like-minded investors with the sole objective of managing the funds with a defined objective. Each scheme will have a stated objective and will be either investing in equity or bonds or a hybrid investment as mentioned in the key memorandum of the schemes.

Mutual funds in India are over 25 years old since the time private funds were introduced and are over 5 decades old since UTI schemes were first launched in 1964.

Mutual funds serve the purpose of the investment vehicle that encompasses the following benefits

- Professional Management

- Transparency and disclosure of portfolio & daily NAV

- Any time liquidity for schemes

- Better tax savings

- Ease and convenience of operations

Mutual funds are different from direct investment in bonds/FD on a few parameters

- Bonds are less liquid than Mutual fund

- Price discovery is difficult for retail investors

- Settlement of transaction is cumbersome

- The concentration of investment in a single bond or issuer is high

Similarly, mutual funds are different from Direct Equity Investments on few parameters

- Stocks concentration is bound to be high

- Stock triggers are difficult to track and price sensitive

- Possibility of liquidity can arise especially for small-cap stocks

- The settlement process is tedious

- Portfolio churn is high and can result in short-term gains

Overall Mutual Funds is a special purpose vehicle with the sole purpose of optimizing the cost of transaction and holding. It offers the benefit of professional fund management and transparent dealing with an objective of generating above-market returns with below market risk

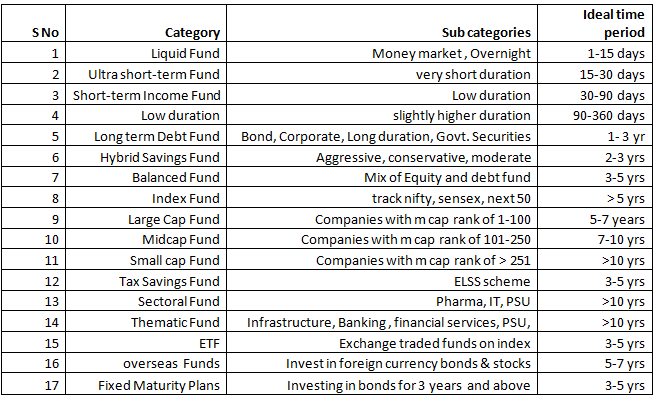

Broadly Mutual funds investments are classified into Equity and Bonds. However, there are more than 2 dozen categories of funds which will help to differentiate one category to another. This would help compare oranges to oranges than anything else

The major categories of mutual fund and the possible time frame of investment based on risk profile in the below matrix will help as a barometer to decide investment choices